Best Trading Tips & Quotes from Alexander Elder | Synapse Trading

Alexander Elder, M.D., was born in Leningrad and grew up in Estonia, where he entered medical school at the age of 16.

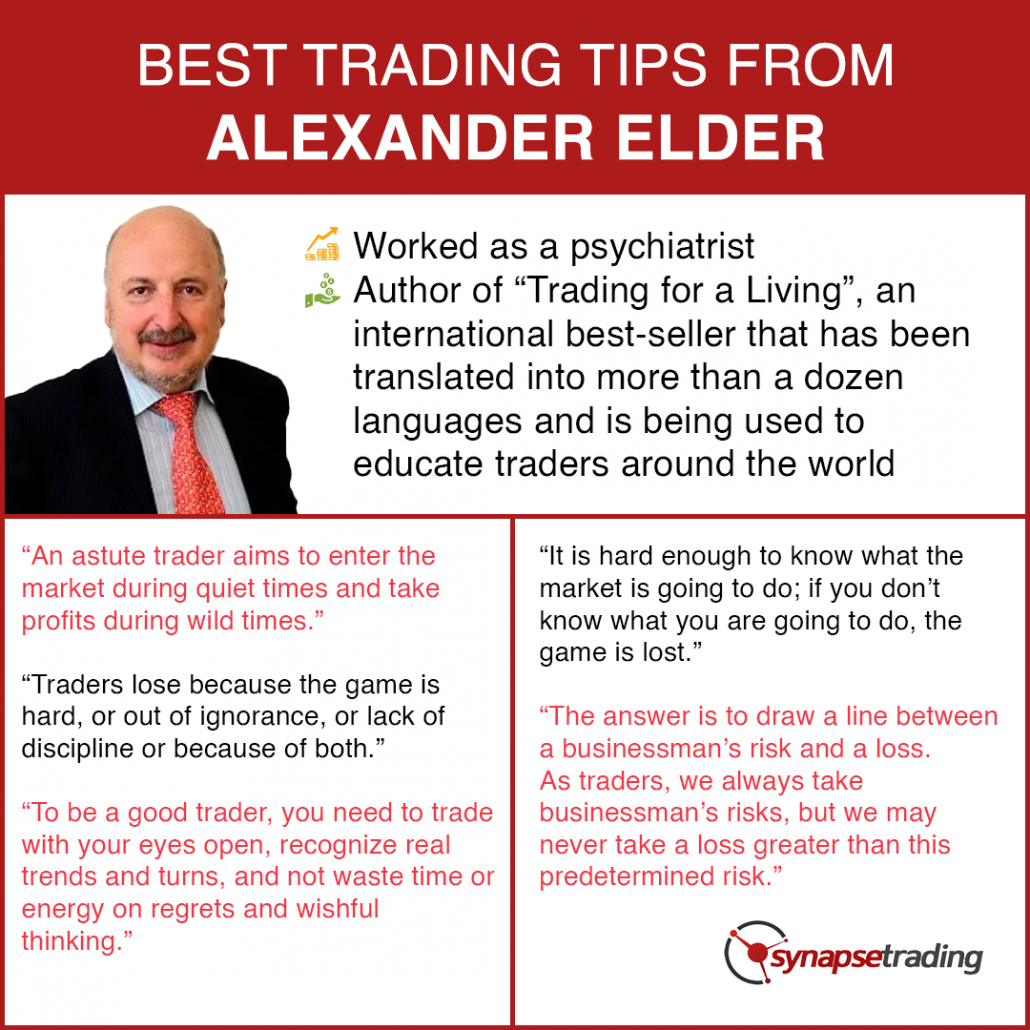

At 23, while working as a ship’s doctor, he jumped a Soviet ship in Africa and received political asylum in the US, where he worked as a psychiatrist.

This provided him with unique insight into the psychology of trading.

He is the author of “Trading for a Living”, considered a modern classic among traders.

First published in 1993, this international best-seller has been translated into more than a dozen languages and is being used to educate traders around the world.

In this post, I will share all the best trading tips and quotes from Alexander Elder, so that we can learn from his knowledge and experience.

Here are some of the best trading tips and quotes by Alexander Elder:

-

Successful trading depends on the 3M`s – Mind, Method and Money. Beginners focus on analysis, but professionals operate in a three dimensional space. They are aware of trading psychology their own feelings and the mass psychology of the markets. Each trader needs to have a method for choosing specific stocks, options or futures as well as firm rules for pulling the trigger – deciding when to buy and sell. Money refers to how you manage your trading capital

-

To be a good trader, you need to trade with your eyes open, recognize real trends and turns, and not waste time or energy on regrets and wishful thinking.

-

The markets are unforgiving, and emotional trading always results in losses.

-

Traders lose because the game is hard, or out of ignorance, or lack of discipline or because of both.

-

Markets need a fresh supply of losers just as builders of the ancient pyramids needed a fresh supply of slaves. Losers bring money into the markets, which is necessary for the prosperity of the trading industry.

-

The goal of a successful trader is to make the best trades. Money is secondary.

-

When a beginner wins he feels brilliant and invincible, then he takes wild risk and loses everything.

-

An astute trader aims to enter the market during quiet times and take profits during wild times.

-

People trade for many reasons—some rational and many irrational. Trading offers an opportunity to make a lot of money in a hurry. Money symbolizes freedom to many people, even though they often don’t know what to do with it.

-

To help ensure success, practice defensive money management . A good trader watches his capital as carefully as a professional scuba diver watches his air supply.

-

It is hard enough to know what the market is going to do; if you don’t know what you are going to do, the game is lost.

-

Every winner needs to master three essential components of trading; a sound individual psychology, a logical trading system and good money management. These essentials are like three legs of a stool – remove one and the stool will fall, together with the person who sits on it.

-

The mental baggage from childhood can prevent you from succeeding in the markets. You have to identify your weaknesses and work to change. Keep a trading diary—write down your reasons for entering and exiting every trade. Look for repetitive patterns of success and failure.

-

There are good trading systems out there, but they have to be monitored and adjusted using individual judgment. You have to stay on the ball—you cannot abdicate responsibility for your success to a mechanical system.

-

The public wants gurus, and new gurus will come. As an intelligent trader, you must realize that in the long run, no guru is going to make you rich. You have to work on that yourself.

-

Many traders ride an emotional roller coaster and miss the essential element of winning: the management of their emotions.

-

If you let the market make you feel high or low, you will lose money.

-

Remember, your goal is to trade well, not to trade often.

-

The answer is to draw a line between a businessman’s risk and a loss. As traders, we always take businessman’s risks, but we may never take a loss greater than this predetermined risk.

-

Being simply “better than average” is not good enough. You have to be head and shoulders above the crowd to win a minus-sum game.

-

Why do most traders lose and wash out of the markets? Emotional and mindless trading are big reasons, but there is another. Markets are actually set up so that most traders must lose money. The trading industry slowly kills traders with commissions and slippage.

-

Use limit orders almost exclusively—except when placing stops. Be careful on what tools you spend money: there are no magic solutions. Success cannot be bought, only earned.

-

It is essential to wait for trades with a good risk / reward ratio. Patience is a virtue for a trader.

-

A loser’s true problem is not account size but overtrading and sloppy money management. He takes risks that are too big for his account size, however small or big. No matter how good his system may be, a streak of bad trades is sure to put him out of business.

-

Most private traders on a losing streak keep trying to trade their way out of a hole. A loser thinks a successful trade is just around the corner, and that his luck is about to turn. He keeps putting on more trades and increases his size, all the while digging himself a deeper hole in the ice. The sensible thing to do would be to reduce your trading size and then stop and review your system.

-

When the market deviates from your analysis, you have to cut losses without fuss or emotions.

-

It pays to write down your plan. You need to know exactly under what conditions you will enter and exit a trade. Do not make decisions on the spur of the moment, when you are vulnerable to being sucked into the crowd. Plans are created by reasoning individuals. Impulsive trades are made by sweaty group members.

Now that I have shared the best trading tips and quotes from Alexander Elder, which is your favourite trading tip?

Let me know in the comments below.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you’re looking for the best trading opportunities every day across various markets, and don’t want to spend hours doing the research yourself, check out our private Telegram channel!

If you’re looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

![]()

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.