What you need to know about Vietnam’s Import Procedures

WHAT YOU NEED TO KNOW ABOUT VIETNAM’S IMPORT PROCEDURE

Although VICO Logistics provides document support for all of your import and export procedures, it is still important for you to understand the ins and outs of these meticulous procedures to learn more about the logistics industry, and how to handle your import procedures in Vietnam for the best possible business strategy.

Mục lục

Import Procedures in Vietnam

When deciding to import goods through trade, the regulations involved in such processes can differ from country to country. However, when importing into Vietnam there are various procedures to look out for in order to ensure your business does not get caught up in any unnecessary issues and trouble.

Export and import of goods in Vietnam are subject to various standards in order to get the go-ahead in customs clearance. The processes in which goods may go through range from quality check, inspection, quantity, and volume verification to just name a few. These regulations are enforced under the customs law and are there to help verify safety through the declaration of goods.

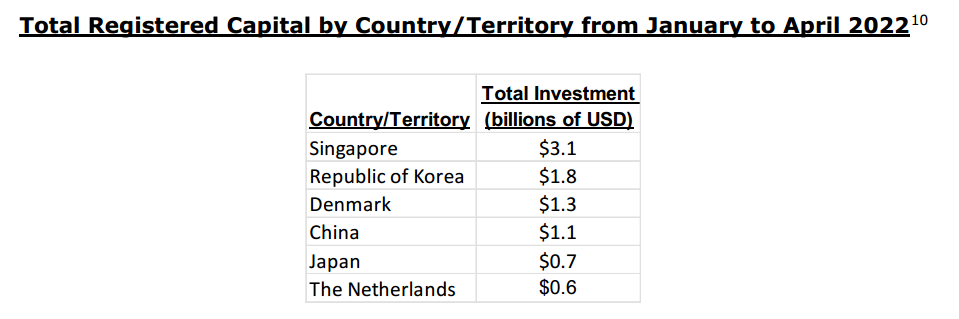

The majority of Vietnam’s FDI has come from and continues to come from Southeast Asia and East Asia. Source from Eurocham

The majority of Vietnam’s FDI has come from and continues to come from Southeast Asia and East Asia. Source from Eurocham

IMPORT PROCEDURES- REQUIRED DOCUMENTS

In order to pass through customs clearance in Vietnam, it is important to submit the required documents to customs authorities. The documents for both import procedures and export include:

Import

-

Declaration Form

-

Bill of Lading

-

Certificate of Origin

-

Import Permit

-

Commercial Invoice

-

Report of Inspection

-

Packing List

-

Delivery Order

-

Health and Technical Certificate

-

Terminal Handling Receipts

Export

-

Permit of Export

-

Electronic Declaration Form

-

Commercial Invoice

-

Bill of Lading

-

Packing List

-

Contract or Agreement

-

Terminal Handling Receipts

IMPORT LICENSE

In order to be eligible for operating import procedures in Vietnam, it is important for investors to register an import license with the DPI or Department of Planning and Investment. In relation to this, an investment certificate must be obtained in order to engage in import procedures and activities.

The length in which companies can wait for such certificates can vary and so it is smart to plan ahead to avoid any supply chain delays. Investment Registration Certificates can take up to 3 weeks, while Trading licenses and Business Registration Certificates can range from 1 to 12 weeks.

It is important for investors to register an import license with the DPI or Department of Planning and Investment.

IMPORT TAX

Before joining the business market in Vietnam, it is crucial to understand the tax system in order to avoid any disruptions and surprise dents to your company’s profits.

Object of Taxation

· Cargo and goods are imported and exported through the Vietnam border.

· Domestic goods are brought into non-tariff barriers and goods from non-tariff into the domestic market.

Non-object of Taxation

· Humanitarian Aid.

· Goods in transit across Vietnam’s borders.

· Goods are transferred through border gates as provided for by the government.

· Goods imported from foreign countries into non-tariff zones, only to be used in non-tariff zones.

Tax Calculation

To calculate the tax for import duty in Vietnam, companies should use the below formula:

Import Tax Duties = Import tax + VAT (if applicable) + SCT (if applicable) + EPT (if applicable)

This formula is made up of which:

· VAT = Value added tax

· SCT = Special consumption tax

· EPT = Environmental protection tax

In relation to tax, it is also important to note that some items may be exempt such as raw materials that cannot be domestically produced, goods imported for re-export, and components used for manufacturing to name a few.

Before joining the business market in Vietnam, it is crucial to understand the tax system in order to avoid any disruptions and surprise dents to your company’s profits.

To conclude, it is important for companies to make themselves aware of the various import procedures when entering the business in the Vietnamese market. Becoming aware of factors such as requirements for documentation, tax, licensing, and related items further helps companies manage their supply chain in an appropriate way. Vietnam's market continues to boom and companies that wish to take the opportunity to import and export should make sure they are well educated on the circumstances that come with such processes.