Metrics for Process and Discrete Manufacturing: An Overview

Manufacturing Efficiency Metrics

- Overall Equipment Effectiveness

Manufacturing Efficiency Metrics

A variety of metrics are employed to analyze not just how much is being produced, but how efficiently.

The most fundamental efficiency metric is unit cost . The more cheaply an item can be produced, the more profits and market share it can ultimately generate. As we’ll see below, adding some basic metrics to unit costs can help explore the actual cost drivers behind this aggregate efficiency measure.

Some key examples include:

- Per unit manufacturing cost excluding materials: materials are a vital part of the cost equation (we’ll look specifically at supply chain metrics below). But deliberately excluding material costs helps metrics shed a more focused light on the efficiency of the production process itself

- Energy cost per unit: energy costs can be high across a wide variety of industries, and tracking them is essential for spotting cost drivers stemming from inefficient energy use (for instance, one production line using far more energy than others making the same product)

- % planned v. emergency work orders: emergency maintenance orders often represent costly work stoppages and changeovers, and comparing these metrics across equipment and production lines can help pinpoint trouble spots

- Downtime v. operating time: this metric provides a very straightforward measure of asset availability, an essential piece of knowledge for spotting maintenance issues

- Avoided cost: preventative maintenance investments need to be measured, too. An avoided cost metric compares maintenance investments to the cost of repairs and lost production due to projected (estimated) maintenance issues

Overall Equipment Effectiveness

Applicable to either a specific piece of equipment or an entire production line, OEE consists of a multiplier of availability, performance, and quality.

By combining these factors, OEE provides an aggregate indicator of a particular production asset’s performance.

OEE metrics center on comparing performance against a benchmark representing an idealized production asset. While some level of deviation is normal, these numbers always provide an excellent guidepost for measuring continuous improvement efforts.

While not as ubiquitous, OLE (Overall Labor Effectiveness) is a similar metric used to track productivity for a given operator, supervisor, team, or shift.

Quality Metrics in Manufacturing

Quality Metrics in Manufacturing

In most industries, some level of defective product is simply part of the cost of doing business although continuous efforts are usually in place to minimize defects through process improvements. The key is monitoring these defects to ensure they are kept at a cost-effective minimum.

These metrics vary slightly depending on where in the production and distribution process defects are caught. For instance, yield describes the overall portion of products that are correctly manufactured to the relevant quality specifications (before scrapping or reworking). Other companies quantify defects as a scrap rate, or portion of incorrectly manufactured product.

Other metrics with names like Customer Rejects or Return Material Authorizations capture defective products returned by customers or distributors. Defect Density is another common metric for measuring production quality which is the number of defective units divided by the total number of units produced.

Supply Chain Metrics

Supply Chain Metrics

Metrics are important for tracking not only the inside production process but the entire supply chain. From burn rates, to inventories, to sales forecasts, many different variables go into efficient supply chain management. As we’ve seen from the COVID crisis, maintaining awareness of the state of your supply chain is essential for staying agile in the face of disruptions (we wrote about this topic specifically here).

From Our Blog:

Major Supply Chain Disruptions Require Responsive Technology: COVID and Beyond

READ MORE >

Supply Chain Metrics Examples

Just a few examples of supply chain metrics include:

- Perfect order measurement: the percent of correct supply orders, which helps measure waste driven by procurement, fulfillment, or invoicing errors

- Cash to cash cycle time: the time between when raw materials are purchased and when the final product is sold to the customer. This metric helps analyze how much operating capital is tied up by a given product or production cycle

- Supply chain cycle time: related to manufacturing cycle time, this metric includes not only production but materials procurement, measure. It is effectively how long it would take to get a finished product in the customer’s hands if starting from zero inventory

- Inventory days of supply: the number of days production lines can operate from current inventory. This metric helps determine how resilient production will be in the face of supply chain disruption

- Inventory turns: how many times is the company’s inventory used up and re-filled (“turned over”) each year or month. Higher turnover generally indicates a more efficient supply chain: materials being purchased are being processed and sold at a higher velocity

- Gross margin return on investment: this metric presents a calculation of the gross profit earned for every dollar invested in inventory. It can be essential for analyzing profitability for products with a profitable sale margin but high inventory carrying costs

Inventory Tracking System Metrics

Inventory Tracking System Metrics

![]()

Effective inventory management matters for manufacturers’ bottom lines. For instance, keeping unduly large inventories of a low-turnover input may needlessly waste storage space and inflate storage costs. A wide variety of companies often have significant amounts of capital tied up in inventory for alternate purposes such as keeping customer satisfaction high or minimizing impact of disruptions from uncertain locales. Tracking how this capital is employed is just as important for maximizing ROI as for investments elsewhere in the production process.

The most effective metrics will take a look at factors like how long a piece of inventory sits in the warehouse, its carrying costs, and lead times for sourcing more. Understanding these parameters is essential for moving toward more efficient inventory management practices.

Warehouses can be a chaotic place, and inventory deviation is another business reality that is important to track with reliable metrics. This metric refers to gaps between the inventory management system records and the levels actually present in the warehouse determined with a physical inventory. While some level of divergence is expected, a dramatic divergence is a sure sign of a costly issue like waste, theft, supplier fraud or simply inaccurate bills of material or erroneous reporting.

From Descriptive Metrics to Analytics and Forecasting

- New Trends in Metrics and Analytics

From Descriptive Metrics to Analytics and Forecasting

In this article, we have focused on how reliable manufacturing metrics are a tool for recording fundamental facts about how a manufacturing organization operates. They’re also the foundation for beginning to use this information more predictively.

The longer key manufacturing metrics are tracked, the more valuable they become. That’s because recording this data over time allows for learning how they function as leading indicators and ultimately using this insight to forecast key trends.

Forecasting is vital for not just anticipating sales, but running a more efficient supply chain. For example, demand forecasting helps companies predict how much raw material they’ll need for future production cycles given expected customer demand. Better demand forecasting not only helps plan effectively but helps maintain a lean inventory and smoother resource utilization.

New Trends in Metrics and Analytics: IoT and Big Data

The “Internet of Things” (IoT) is a technology trend that is much broader than manufacturing. Specifically, IoT refers to any network of physical devices that are able to collect data and interface directly with connected sensors and software. Prominent examples include new concepts like “Smart Cities” and “Smart Homes.” While these consumer-facing applications may garner more headlines, manufacturing is the leading investor of any sector ($187 billion as of 2018).

This trend is particularly important for manufacturing because IoT brings the potential to create an unprecedentedly data-rich factory. IoT platforms are proliferating, offering scalable, networked data collection devices that can be customized to collect data like temperature, vibration levels, sound levels, humidity, pressure, and a variety of other operating conditions. Many of these sensors are extremely small and can be installed in a huge variety of equipment. These sensors can immediately transform a simple piece of production machinery into a “smart device,” and their value only grows as more devices are integrated into the IoT network. As data is collected over time, the relationships between these new data streams can be analyzed to generate a much more granular understanding of the overall manufacturing process.

Preventative maintenance, for example, is just one use case where the value of IoT is readily apparent. Granular data on equipment operation can detect potential maintenance issues long before they can be anticipated through human observation (or simply from dwindling performance). This knowledge effectively allows machinery to be maintained based on actual operating conditions rather than regular maintenance schedules. Research suggests that this use case alone can improve equipment efficiency by 20-30%.

The potential of IoT, however, also comes with an imperative to process higher volumes of data than ever before. The immense amount of data that can be captured by networked sensors creates new demands on technology infrastructure. Effectively harnessing the IoT trend requires the ability to collect, store, and process more data than ever before. That’s why IoT is inseparable from another burgeoning trend: Big Data.

In a nutshell, Big Data refers to the technology infrastructure needed to process, store, and analyze the unprecedented volumes and varieties of data generated by today’s enterprises (IoT is just one example of this voluminous data generation). This data needs to be structured and stored in a database that allows for subsequent queries and analytics to be performed rapidly. This scale of data processing capability was historically only available to large, technology-oriented companies, but cloud-based platforms are making it more accessible than ever. Additionally, artificial intelligence (AI) and machine learning learning technologies are increasingly utilized to aid the process of big data analysis. This article provides a useful overview of the big data framework in relation to manufacturing IoT.

These cloud-based solutions are becoming easier to manage and less costly all the time, helping propel IoT as part of the cluster of “Industry 4.0” technologies with a massive economic impact that is only beginning to be realized.

The Technology Foundation for Effective Manufacturing Metrics

The Technology Foundation for Effective Manufacturing Metrics

Taking advantage of all the available metrics for a given industry requires the right technology infrastructure. In many cases, maximizing the value of these metrics is simply about ensuring that the needed data is available when it’s needed, where it’s needed (even in the face of a major disruption). For example, employees need alternative methods for accessing key operational metrics in disaster recovery scenarios (especially, as with the COVID crisis, when employees lose access to key technology).

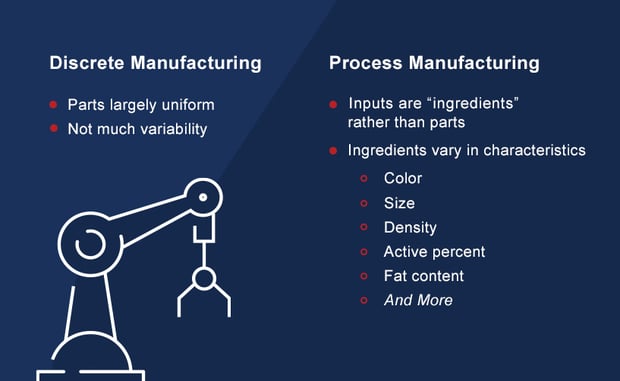

Successfully making use of the metrics discussed above doesn’t always require complicated solutions, but it does require software that fits specific business needs. Today, for example, there are many software products designed specifically to address the unique needs of process manufacturers.

A multi-disciplinary project team with the knowledge and experience necessary to select and implement the right software is the best foundation for taking full advantage of robust, timely metrics.

PSGi has extensive experience working closely with customer teams to support and manage this software foundation. We take pride in getting to know the daily operational details of our client’s businesses: that’s the only way to ensure metrics are employed to their maximum potential.

If you’re interested in talking with manufacturing software experts about using metrics more effectively, you can reach out to our team using the button below.

Scheduling production runs in a process manufacturing environment can be very complicated due to material variability, differing batch sizes, a need to schedule dedicated equipment, and more.

Scheduling production runs in a process manufacturing environment can be very complicated due to material variability, differing batch sizes, a need to schedule dedicated equipment, and more.